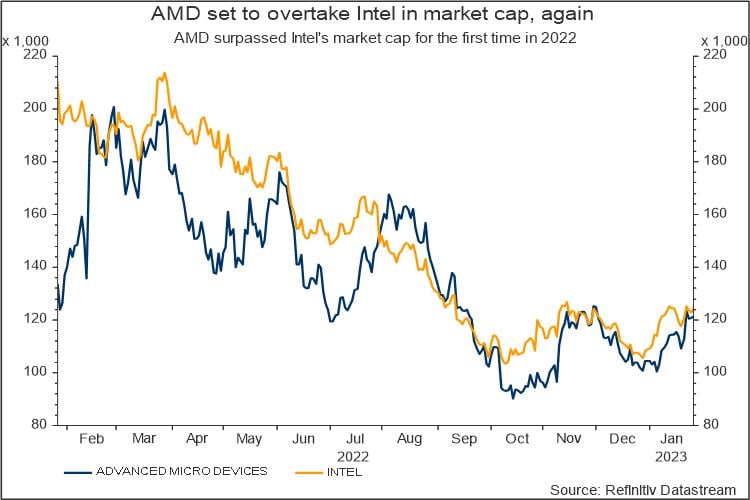

Intel saw about $8 billion wiped off its market value on Friday after the US chipmaker stumped Wall Street with dismal earnings projections, fanning fears around a slump in the personal-computer market.

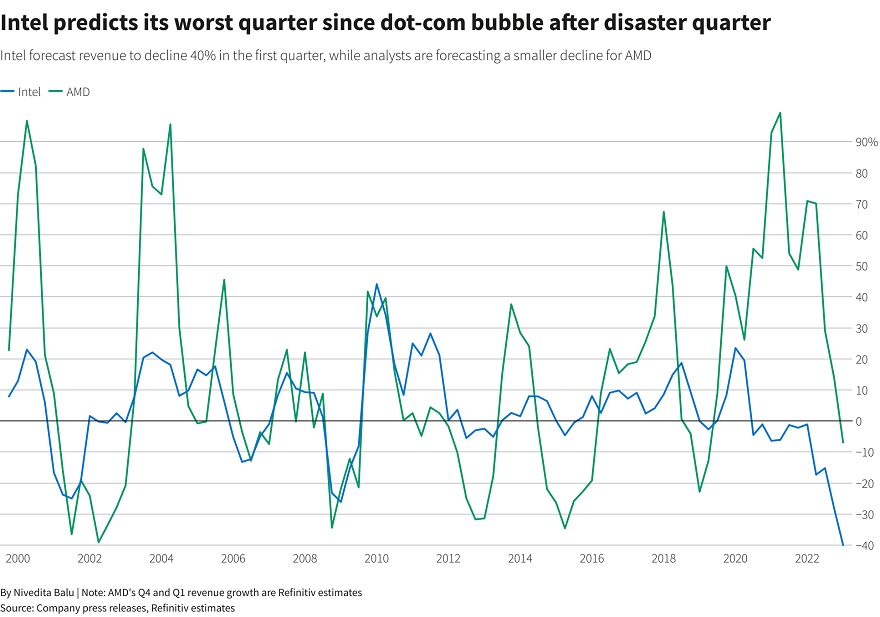

The company predicted a surprise loss for the first quarter and its revenue forecast was $3 billion below estimates as it also struggled with slowing growth in the data centre business.

Intel shares closed 6.4% lower, while rival Advanced Micro Devices and Nvidia ended the session up 0.3% and 2.8%, respectively. Intel supplier KLA settled 6.9% lower after its dismal forecast.

“No words can portray or explain the historic collapse of Intel,” said Rosenblatt Securities’ Hans Mosesmann, who was among the 21 analysts to cut their price targets on the stock.

The poor outlook underscored the challenges facing Chief Executive Pat Gelsinger as he tries to reestablish Intel’s dominance of the sector by expanding contract manufacturing and building new factories in the United States and Europe.

The company has been steadily losing market share to rivals like AMD, which has used contract chipmakers such as Taiwan-based TSMC to make chips that outpace Intel’s technology.

“AMD’s Genoa and Bergamo (data center) chips have a strong price-performance advantage compared to Intel’s Sapphire Rapids processors, which should drive further AMD share gains,” said Matt Wegner, analyst at YipitData.

Analysts said that puts Intel at a disadvantage even when the data center market bottoms out, expected in the second half of 2022, as the company would have lost even more share by then.

“It is now clear why Intel needs to cut so much cost as the company’s original plans prove to be fantasy,” brokerage Bernstein said.

“The magnitude of the deterioration is stunning, and brings potential concern to the company’s cash position over time.”

Intel, which plans to cut $3 billion in costs this year, generated $7.7 billion in cash from operations in the fourth quarter and paid dividends of $1.5 billion.

With capital expenditure estimated to be around $20 billion in 2023, analysts said the company should consider cutting its dividend.